Why Infrastructure Comes First

Frédérique Dame helped scale Uber to 400 cities. Now she applies those lessons to fix the gaps in women's health and agentic commerce.

Operational experience serves as the primary lens for identifying opportunity in the current venture landscape. Frédérique Dame, General Partner at GV (Google Ventures), embodies this “operator-investor” model. Dame spent 15 years building consumer and enterprise products, including a pivotal role at Uber. She joined the ride-sharing company as employee 85 and led product and engineering efforts that scaled the organization to over 7,000 people. She helped grow operations from 14 cities to over 400 globally, giving her a distinct understanding of what execution at scale requires.

Dame has invested at GV for over seven years. She applies the disciplined prioritization and infrastructure mindset honed during her operating career to seemingly disparate domains. She focuses on the fragmented landscape of women’s healthcare and the nascent shift toward AI-driven “agentic” commerce. Her core conviction is clear. Systemic inefficiencies, whether in managing menopause or automating social commerce, require infrastructure-level solutions built by founders with deep operational pedigrees. Her strategy focuses on capitalizing on the fragmentation of legacy systems. She moves beyond broad platforms to build specialized, intelligent intermediaries.

The GV Approach

As the venture capital arm of Alphabet Inc. (Google), GV operates as a generalist firm investing in companies from seed to growth stage. The firm organizes its investments into five primary sectors: AI, Consumer, Enterprise, Frontier Tech, and Life Sciences. While GV explores emerging trends, its strategy focuses on backing founders across a wide range of industries rather than targeting specific mature markets.

GV distinguishes itself through its focus on the operator. The firm moves beyond simply funding startups: It backs founders with deep operational pedigrees. Veterans from companies like Stitch Fix, Meta, and Uber possess the tactical experience to navigate complex regulatory and technical landscapes. The scale of capital deployed signals a conviction that the next category-defining companies will build deep, proprietary data moats rather than thin application layers.

Dame specializes in disruptive technologies in the consumer space, healthcare, and emerging AI platforms. She co-leads GV’s Women’s Health team, spearheading investments such as Allara Health, Found, Midi Health, and Oula Health. Her background leading product efforts during periods of significant organizational scaling helps her see what others miss.

From Operator to Investor

Dame forged her investment lens through a career defined by technical expertise and a focus on scalable infrastructure.

Dame grew up in France and moved to the U.S. after earning master’s degrees in telecommunications and spacecraft technology. She wanted to work on products she would actually use, so she switched from enterprise software to consumer roles at Yahoo. While managing social strategies there from 2004 to 2008, she learned how to build at scale. She realized that adding user-generated content, like reviews, meant she also had to build the tools to moderate it.

A pivotal shift occurred in 2012 when she moved to Uber. Although the company already operated in 14 cities, she spent the next four years helping scale operations to 68 countries. She spearheaded strategic programs focused on scaling the global driver workforce and automating internal systems for employee productivity.

This experience taught her the critical lesson of prioritization. When she joined, critical driver information lived in spreadsheets. Her task involved moving operations to automated systems and building the backend infrastructure to automate driver onboarding. When users noted that the early app lacked GPS directions, Dame recognized the strategic necessity of focusing on supply infrastructure before customer-facing features. She noted that adding driving directions helps little if the supply is missing. Without the supply, you have nothing. This infrastructure-first mentality helps define her approach at GV today.

Today, Dame applies that same supply-side logic to a different problem: women’s health. Just as she once identified that an app is useless without drivers, she recognized a massive gap in the medical infrastructure available to women. She observed that many women “suffer in silence” simply because they “are used to how it is.” The data highlighted a clear mismatch between supply and demand. Dame points out that while women live to be 80 on average, they spend “a third of their life” in perimenopause or menopause. Without the right care infrastructure to support women their quality of life is undermined. For Dame, the goal became building the systems necessary so women aren’t just living longer, but “living better longer.”

Thesis 1: Expanding Beyond Fertility

Historically, venture capital investments in women’s health focused mostly on fertility and pregnancy. Frédérique Dame and her team at GV have taken a broader approach, emphasizing that those areas make up only a small part of a woman’s life. Instead, they look for companies that support women through their entire biological lifecycle. This means backing startups that fill specific gaps in care, ranging from chronic conditions to menopause and maternity infrastructure.

This strategy aims to fix the disconnected nature of the current healthcare system. The data shows a clear need for this wider focus. For example, about 57 million women in the U.S. are currently navigating menopause symptoms, yet there is a shortage of doctors trained to treat them. This gap in care affects the economy, resulting in an estimated $1.8 billion in lost wages annually. Additionally, more than one in three women in the U.S. suffer from chronic conditions like PCOS or endometriosis, where care is often scattered and difficult to access.

GV believes scaling requires integration into the established reimbursement infrastructure. The firm favors specialized virtual care layers over generalist telehealth. They back founders who prioritize insurance integration.

Midi Health: GV led the Series A for Midi, a virtual care clinic for women in midlife. Midi prioritized insurance integration. They positioned themselves as the first menopause-care platform to provide meaningful insurance coverage. This strategy embeds the platform within the healthcare payment stack and turns it into workforce retention technology.

Allara Health: GV led the $10 million Series A for Allara which functions as a virtual “medical home.” It creates a collaborative care platform that pairs patients with doctors and dietitians to manage PCOS and endometriosis. Allara demonstrated rapid traction by going in-network with major insurers in eight states within one year.

Thesis 2: The Agentic Commerce Revolution

Parallel to the shift in healthcare delivery, Dame bets on a fundamental change in commerce architecture. Investments in Nectar Social, Daydream, and Checkmate suggest that the traditional e-commerce stack is becoming obsolete. GV funds “agentic” interfaces and social operating systems that leverage AI to change how consumers find and buy products.

This thesis relies on the behaviors of Gen Z and Gen Alpha consumers. The core insight involves the decline of the traditional marketing funnel. Younger consumers discover products on social media and expect to transact in the moment. Brands often struggle with the volume of interactions. Furthermore, first-party attribution data is critical in a post-cookie advertising world.

Nectar Social: Dame co-led the $10.6 million seed round for Nectar. This platform uses AI agents to automate responses to high-intent interactions. It effectively turns the social media inbox into a sales channel. Nectar solves the attribution problem by connecting specific social interactions to purchase data.

Daydream: GV participated in a $50 million seed round for Daydream. Led by e-commerce veteran Julie Bornstein, Daydream posits that generalist search engines fail for taste-based categories. It leverages Generative AI to understand nuanced, natural language queries. It functions as an intelligent layer that disrupts the standard search paradigm.

Thesis 3: The Infrastructure Imperative

Dame’s operational experience translates into a conviction that foundational infrastructure unlocks scale. This lens extends across her portfolio. She focuses on the invisible infrastructure that enables efficiency and mitigates risk in fragmented markets.

As industries scale, reliance on manual systems becomes a liability. Automation and digitization serve as necessary preconditions for sustainable growth.

TMRW Life Sciences: TMRW provides critical back-end infrastructure for fertility care. As the demand for IVF grows, the manual management of frozen specimens creates risk. TMRW introduces an automated, robotic platform for tracking and storing frozen eggs and embryos. This investment secures the supply chain of biological assets.

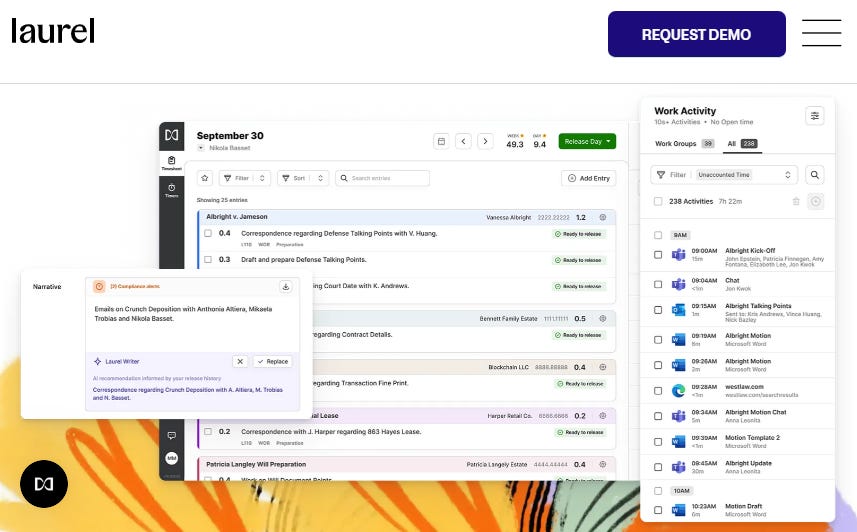

Laurel: GV participated in Laurel’s $100 million Series C. Laurel is an “AI time platform” for professional services that automatically captures and categorizes work. Dame notes that Laurel creates the enterprise intelligence layer for knowledge work. By capturing time data, the system makes knowledge work measurable and automatable.

The Power of Vertical Specialization

Dame’s investments remain highly vertical and specialized. Midi solves menopause. Daydream solves fashion search. Laurel solves professional services timekeeping. This implies a skepticism that horizontal, generalist platforms can effectively address complex conditions or nuanced workflows. The conviction is that value lies in deep, specialized integration.

By applying the lessons of rapid scaling to the specialized domains of women’s health and AI-driven commerce, Frédérique Dame helps construct a new operating layer for the economy. In this layer, care is continuous, and commerce is intelligent.