The AI-Native System of Record

Why John Locke Is Convinced the Real AI Winners Won’t Be Wrappers, But the Systems They Run On.

John Locke

The Uncovered Crew is diving into the thesis of John Locke, a partner at Accel. In a venture landscape flooded with AI-first wrappers and horizontal apps, Locke is making massive, high-conviction bets in a completely different direction.

He’s backing companies that are building AI-native systems of record for complex, less exciting enterprise verticals. Locke’s thesis is that the real, defensible value isn’t in the AI model itself, but in using AI to rebuild the core infrastructure and workflow of entire industries—like legal and finance—from the ground up.

And when he finds a company that proves this thesis, he’s willing to ignore traditional fundraising timelines and invest with speed and conviction.

TL;DR: Theses and Key Quotes

Bet on Plumbing, Not Paint

“The real opportunity is not in thin AI features but in building new, AI-native systems of record (like an ERP) that replace legacy giants.”

Vertical Wins

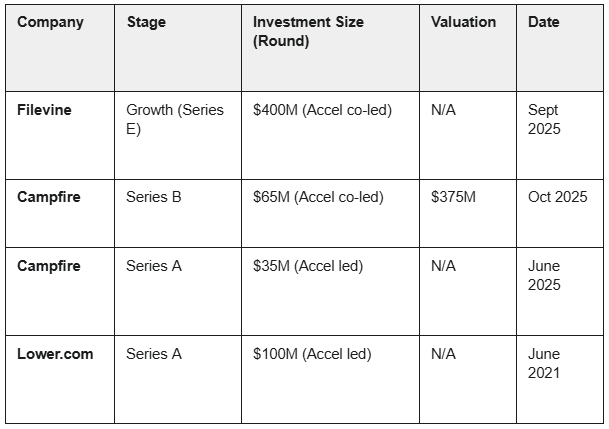

“Target industries with high complexity, massive spend, and ancient incumbent software, like legal (Filevine) and corporate finance (Campfire).”

Conviction > Convention

When market demand is overwhelming and a thesis is being proven, act with speed. Locke led a Series A and co-led a Series B for Campfire just 12 weeks apart.

On the AI System of Record

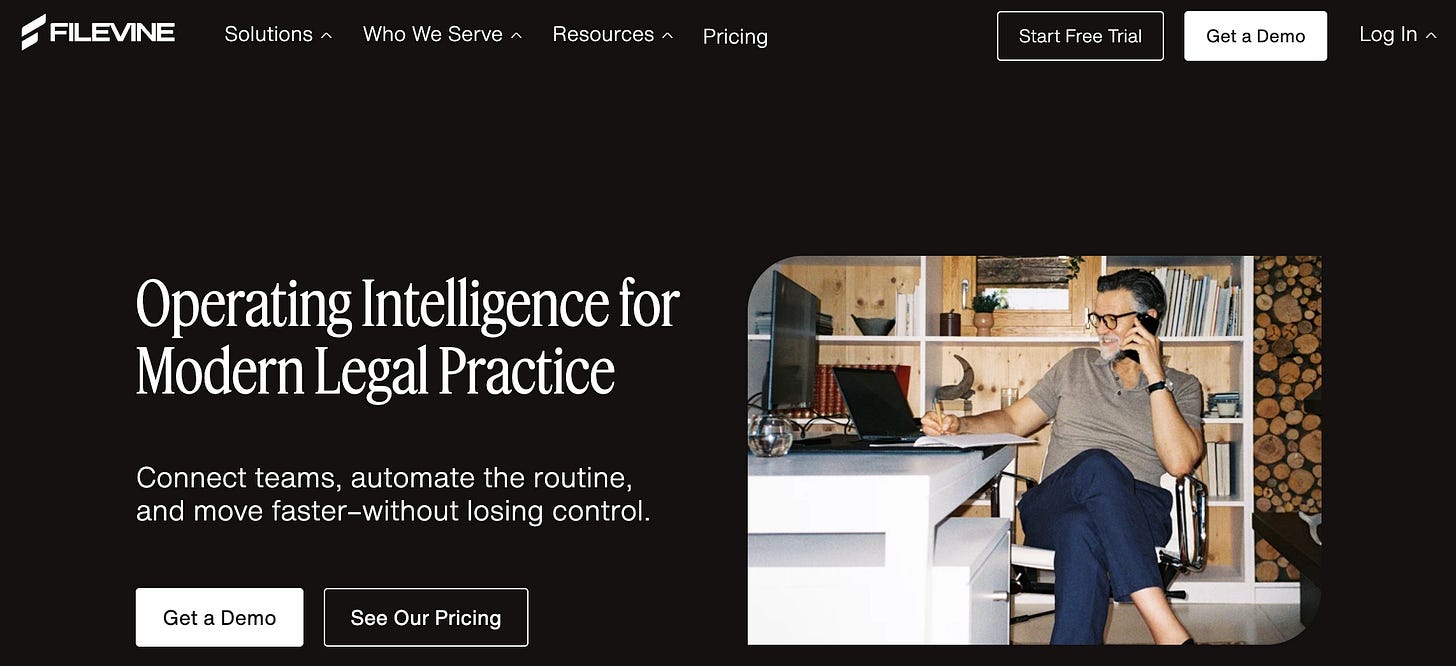

“Filevine is tackling a problem that others are missing by developing a system of record where AI is seamlessly woven into every function...”

On Overwhelming Market Signal

“That’s always a great proxy for us... The demand is quite a bit higher than what we even anticipated.”

The Platform: Accel

To understand Locke’s thesis, you have to understand Accel’s platform. The firm has a long history of backing founders with “grit and scrappiness” who have proven their model, often by bootstrapping to significant scale before taking on major capital.

This “bootstrapped lineage” includes giants like Atlassian and Qualtrics. This philosophy shapes a worldview that values substance over hype and looks for a strong, proven foundation for long-term success. Venture capital is seen as an accelerant for a proven engine, not fuel to find a match. Locke’s recent investments are a modern-day extension of this philosophy: find a company solving a real, expensive problem and then provide overwhelming firepower to win the market.

The Navigator: John Locke’s Philosophy

John Locke’s investment philosophy is defined by a search for structural disruption. Based on his public writing and recent investments, his focus is not on what’s merely popular but on what is foundational.

His thesis isn’t about “AI” in isolation. He always pairs it with structural terms: “system of record” (for Filevine) and “ERP for the future” (for Campfire). His investments are not bets on a specific AI model; they are bets on full-stack business-model disruption that is enabled by AI.

He looks for signals that cut through the noise. While many VCs are chasing horizontal AI applications, Locke’s trigger is seeing intense, real-world market pull from sophisticated buyers. When other Accel portfolio companies are clamoring to use a product, that’s the signal.

Thesis 1: The “AI-Native” System of Record

The core of Locke’s thesis is that standalone AI tools are inefficient. He argues that “fragmented tools create silos” and that the true winner in any enterprise vertical will be the core operating system where all the work already happens.

The opportunity isn’t to sell an AI feature to a law firm; it’s to replace the law firm’s entire legacy operating system with one built from the ground up with AI at its core. He targets industries like legal and finance because they have high complexity, massive spend, and are trapped on ancient incumbent software (think NetSuite or SAP).

This is a bet on the “plumbing” over the “paint.”

Supporting Investments:

Why This Is Important

This thesis provides a clear map for navigating the AI hype cycle. It suggests that the long-term, defensible venture outcomes will not be “wrappers” but full-stack, vertical-specific platforms. By focusing on the system of record, Locke is betting on companies that can achieve true platform lock-in, embedding themselves into the mandatory, core workflows of an entire industry.

Enjoying Thesis Uncovered? Subscribe for the latest content.

Thesis 2: Aggressive, Rapid Follow-On (The Conviction Thesis)

When a thesis is being proven correct faster than anticipated, Locke’s actions show he is willing to throw out traditional fundraising timelines and invest with extreme aggression.

The signal is overwhelming market demand. His thesis is that in this scenario, the primary risk is not capital or valuation; the primary risk is speed.

The primary evidence is his investment in Campfire.

June 2025: Accel leads the Series A.

October 2025: Accel co-leads the Series B just 12 weeks later.

This is a massive, public signal of conviction. Locke’s own rationale provides the “why”: the demand from sophisticated buyers (including other Accel portfolio companies) was “immense” and “quite a bit higher” than even they had anticipated.

He didn’t wait the typical 18-24 months. He moved to capitalize the company to meet the opportunity now.

Why This Is Important

This thesis is a high-conviction approach to venture. It demonstrates a willingness to double down—aggressively and publicly—when a company’s real-world traction outpaces the original model. It suggests that when a company has clearly hit a nerve and is solving a deep, expensive problem, the right move is to end the race for capital early and focus all energy on execution and market capture.