Beyond the Hype: Cathy Gao’s Focus on Vertical AI and the ‘10x Provider’

Sapphire Ventures is investing $1B in 'insanely deep' AI startups. Here's the strategy.

In the landscape of AI investment, few voices are as specific and testable as Cathy Gao, a Partner at Sapphire Ventures. In a market flooded by generic ‘AI in healthcare’ talk and fears that ‘Microsoft will just add that feature,’ Cathy’s perspective on Sapphire’s investment strategy cuts through the noise. Helping to lead the firm’s approach in these verticals, she emphasizes that the real opportunity is not in competing with horizontal giants but in going ‘insanely deep’ into messy, specific industry workflows.

TL;DR

Vertical AI is the Moat: Startups will not win by competing with Microsoft’s horizontal copilots. They’ll win by going “insanely deep” into complex verticals (like tax law) that big tech cannot or will not touch. Depth is the new defensibility.

The ‘10x Provider’ is Coming: The healthcare stack is being rebuilt around three new AI layers: data activation, administrative automation, and, ultimately, tools to make a physician 10x more effective.

Observations on Voice AI: Reflecting on market observations, Cathy noted the potential for Voice AI to become the default patient engagement channel within the next 12-18 months. This indicates a possible acceleration of healthcare’s typical tech adoption cycle.

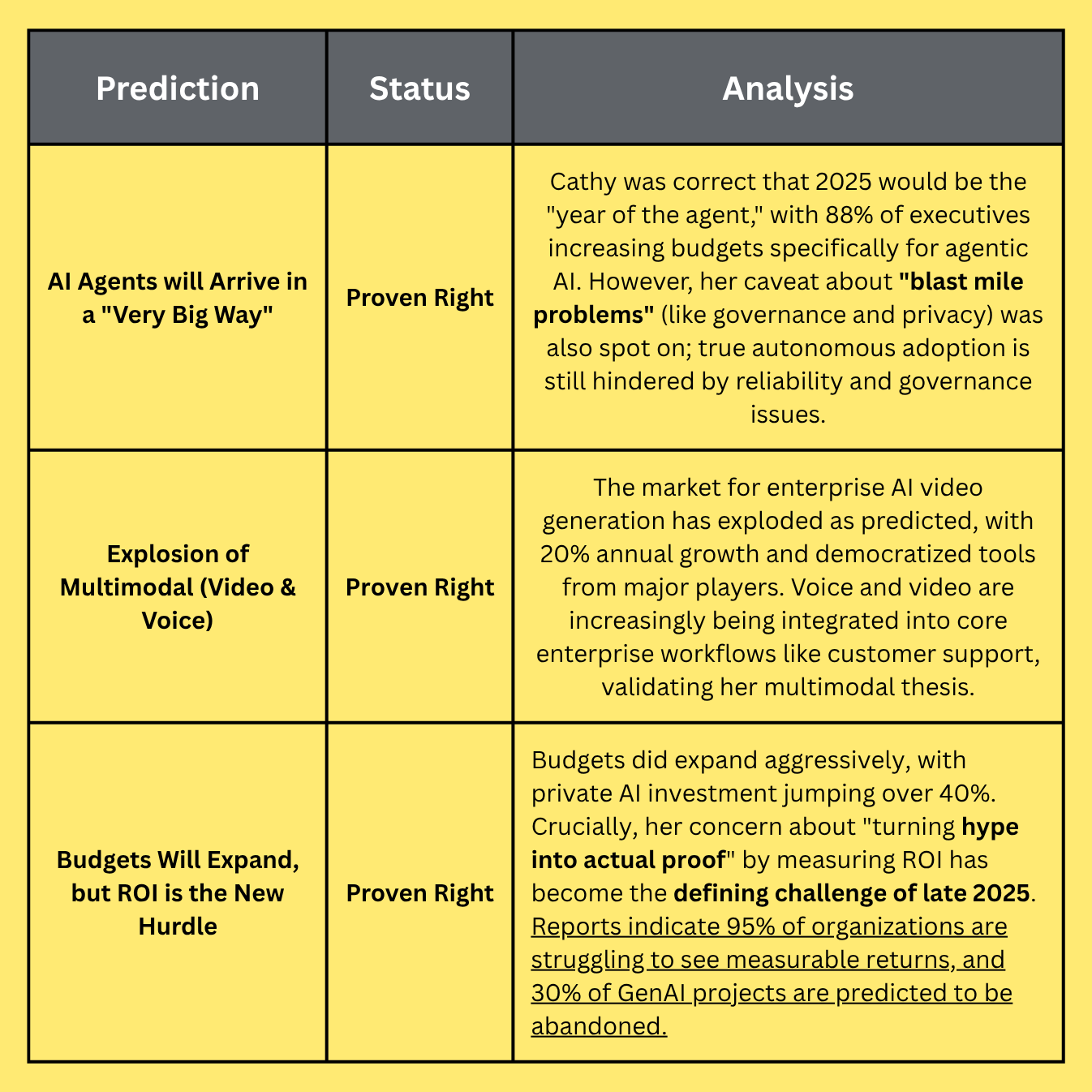

The 2025 Test: ROI is the Hurdle: Looking ahead, Cathy observed that while AI budgets appeared poised to expand, the new challenge would be “turning hype into actual proof”. She noted potential “last mile problems” like governance and privacy that could hinder true autonomous agent adoption.

Sapphire Ventures

The Firm’s Identity: Sapphire Ventures is a global B2B software venture capital firm managing over $11 billion in assets. The firm’s primary investment team, where Cathy is a Partner, is known for its expansion-stage focus, typically targeting Series B through IPO companies that have already achieved scale (e.g., $10M+ in Annual Recurring Revenue). Their track record includes over 80 exits including 30 IPOs, with historical wins like Square (Block), LinkedIn, DocuSign, Looker, and MuleSoft.

The Overarching Philosophy: Sapphire’s core philosophy is its “Portfolio Growth” platform. This is not just a value-add; it is a dedicated, in-house team of operators whose job is to help companies scale. In practice, this means providing portfolio companies with strategic customer introductions to Global 2000 companies, access to a network of over 7,000 executives for key hires, and advisory on international expansion. This hands-on, operational support is a key part of their model and has earned the firm an 82 CEO Net Promoter Score (NPS) from its portfolio companies.

Alignment: Cathy’s work is a direct execution of the firm’s central strategy. Sapphire Ventures is aiming to invest over $1B in enterprise AI, with a deep focus on ‘vertical SaaS’ and ‘health tech.’ Cathy is helping to lead Sapphire’s strategy across these verticals. Consequently, the firm’s investments in Blue J (Vertical AI for tax) and EliseAI (Vertical AI for housing and healthcare) are not side projects; they are the playbook.

The Founder’s Question: “Am I too early for Sapphire?” While Sapphire’s official target is expansion-stage ($10M+ ARR), the firm has made exceptions for an exceptional thesis fit. The primary focus is on growth, typically leading B2B rounds in the $25M to $60M range and advising on $30M+ Series C rounds. However, Sapphire may lead an earlier round if the conviction is high, as demonstrated when the firm led the Series A for Jeeva.ai.

Cathy Gao’s Journey

The Journey: Cathy’s perspective is uniquely shaped by a career spent on all sides of the table. As the daughter of a software engineer and a small business owner, she was “immersed in technology and entrepreneurship from a very early age”.

Her path was not a straight line to VC. She started in finance, building fundamental models as an analyst in Blackstone’s M&A group and later in growth equity at TA Associates. But she felt the pull to build, moving to San Francisco to become an operator at the fast-growing Series B startup Gusto, where she worked across finance, strategy, and product. This experience gave her the “operator” empathy that now defines her. She returned to investing, first at AXA Venture Partners and then joining Sapphire in 2019.

The “Why”: Her dual background in finance and operations gives her a passion for “deeply understanding business models” while also “working hand-in-hand with entrepreneurs to help scale companies”. She describes investing as the “best job in the world” because it pays you “to learn something new every day”. This drive is built on her stated core values: conviction, partnership, and passion.

Investment Philosophy: Cathy is known for being “incredibly founder-focused,” acting as a “thought partner and a true champion through the ups and downs”. When evaluating opportunities, she values an investor’s ability to be “creative and proactive in gaining even a slight edge to build conviction,” whether through a unique network or by “connecting seemingly unrelated dots”.

Deep Dive into The Theses

This is where we explore the high-conviction ideas shaping Cathy’s worldview. Two strong theses emerge: the reorganization of healthcare by AI and the defensible moat of deep, vertical-specific AI.

Thesis 1: The “10x Provider” & The AI Healthcare Stack

The “What” (The Opportunity): This thesis moves beyond generic hype to map a specific, three-layer stack that will redefine care delivery. Cathy’s model includes:

Data Activation: Unlocking the vast, siloed data within health systems.

Admin Automation: Deploying AI to manage the heavy administrative burden.

The “10x Provider”: Creating AI-powered tools that augment a physician’s capabilities, aiming to make them 10x more effective and efficient.

The “Why Now” (The Rationale): The thesis is anchored by a strong, time-bound prediction. Cathy predicts that Voice AI will become the default patient engagement channel within the next 12-18 months. This ambitious timeline suggests a belief that the technology is finally mature enough to break healthcare’s notorious adoption bottlenecks.

The Conversation (Nuance and Debate): This bold thesis brings up critical challenge questions:

The Adoption Cycle Challenge: Healthcare is famously slow to adopt new “default” channels, citing complex regulations like HIPAA and older patient demographics. What makes Voice AI so compelling that it can overcome this inertia in just 12-18 months?

The Burnout Challenge: The “10x provider” concept is powerful, but what if the tools fail? There’s a significant risk that new AI tools could increase alert fatigue (the overwhelming number of digital notifications) worsening physician burnout rather than reducing it.

Thesis 2: Vertical AI Beats Horizontal Incumbents

The “What” (The Opportunity): This thesis directly counters the prevailing market fear that “Microsoft will just add that feature”. It concedes that large, horizontal players like Microsoft and Google will win the general-purpose AI game (e.g., basic copilots). The real venture-scale opportunity is for startups that go “insanely deep” into specific verticals.

The “Winning Profile” (What They Look For): These startups win by integrating into the messy, high-stakes, and specific workflows—like tax law or property management—that horizontal players simply won’t or can’t touch. This is a high-conviction bet that depth is a sufficient moat against big tech. As horizontal AI becomes a commodity, the value shifts to applications with deep domain expertise. Sapphire is backing this thesis with significant capital, as seen in their investments in Blue J (Tax) and EliseAI (Housing).

The Conversation (Nuance and Debate): This strategy surfaces two classic, hard-nosed VC questions:

The TAM Question: Does extreme verticalization limit the Total Addressable Market (TAM) too much? If the AI is wildly successful at automating away the very complexity that justifies its high price, does the market opportunity shrink, making venture-scale returns impossible?

The “Services” Trap: Are these vertical AI companies just “services businesses” disguised as high-margin software? High-stakes fields like tax law often require a heavy human-in-the-loop (HITL) to manage exceptions and provide assurance, which can destroy software margins and scalability.

Revisiting Cathy Gao’s 2025 Predictions

Its not often that we get to see a VC’s time-bound predictions play out in real-time. But thanks to an interview Cathy Gao gave on Bloomberg Technology in early January 2025, titled “The Evolution of AI Agents”, we can do just that.

As of November 2025, we analyzed three primary discussion points from that interview. It is important to note that statements made regarding predictions in January 2025 are a reflection of Cathy’s observations at that time only, and that Sapphire Ventures has no influence on those statements / viewpoints. The status and analysis reflect the observations of Uncovered Media.

Source:The GenAI Divide STATE OF AI IN BUSINESS 2025 (MIT)

Why This is Important

Cathy Gao’s investment theses provide a clear playbook for navigating the hype. While much of the market chases horizontal platforms or general-purpose AI, her focus remains firmly on vertical specialization and proof. The firm’s investments in vertical-specific AI and the measurable ‘10x provider’ demonstrate a conviction that the next wave of value won’t come from novelty, but from the hard work of integrating into messy, real-world workflows. It is a pragmatic, operator-first perspective that sees AI not as a universal fix, but as an effective tool for solving specific, high-stakes business problems.